Attention Tax Year 2020 Wage Filers:

The separate instructions for filers/issuers for Form 1099-NEC are available in the 2020 Instructions for Forms 1099-MISC and 1099-NEC. Want To File Forms W-2/W-2c and W-3/W-3c Electronically? Visit the Social Security Administration's Employer Reporting Instructions and Information website to complete and file electronic Forms W-2 and W-3. Click Insert Forms New Form to begin creating your form. Note: To enable the Forms button, make sure your Excel workbook is stored in OneDrive for work or school. Also note that Forms for Excel is only available for OneDrive for work or school and new team sites connected with Microsoft 365 Groups.

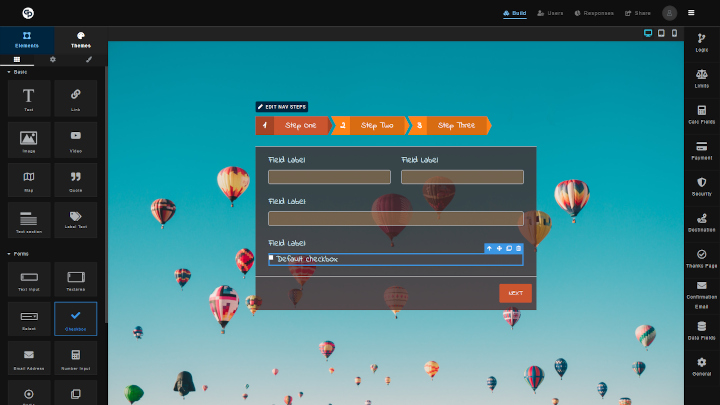

- If a form doesn’t almost instantaneously get us what we want, we ditch the page. Here, we’ve collected some of the most impressive online forms so you can learn by example, and hopefully apply some of these methods to your own web forms moving forward.

- Easy-to-Use Online Form Builder Easily create the forms you need to collect data, files and payments — without writing code.

- Create forms in minutes. Send forms to anyone. See results in real time.

Wage reports for Tax Year 2020 are now being accepted.

Please visit our What's New for Tax Year 2020 page for important wage reporting updates.

Reminder, Tax Year 2020 wage reports must be filed with the Social Security Administration by February 1, 2021.

/GettyImages-538807532-59c441cb9abed500113df68c.jpg)

COVID-19 Alert

Due to the COVID-19 pandemic, our BSO Customer Service and Technical Support staff is currently limited and hold times on the phone may be longer than usual. If you need immediate assistance, our toll free number is 1-800-772-6270 (TTY 1-800-325-0778) and is available Monday through Friday, 7:00 a.m. to 7:00 p.m., Eastern Time.

For general assistance, you may send us an email at employerinfo@ssa.gov. For technical assistance, please send us an email at bso.support@ssa.gov. We thank you in advance for your patience and understanding.

Online Form 1

Please review our current guidance for in-person appointments if you require a visit to one of our Field Offices.

Register to Use Business Services Online

You must register to use Business Services Online – Social Security’s suite of services that allows you to file W-2/W-2Cs online and verify your employees’ names and Social Security numbers against our records.

File W-2s/W-2Cs Online

This service offers fast, free, and secure online W-2 filing options to CPAs, accountants, enrolled agents, and individuals who process W-2s (the Wage and Tax Statement) and W-2Cs (Statement of Corrected Income and Tax Amounts).

Verify Employees’ Social Security Numbers

The Social Security Number Verification Service allows employers to verify the names and Social Security numbers of current and former employees for wage reporting purposes only.

Social Security also offers the Consent Based Social Security Number Verification Service.

Helpful Hints to Electronic Filing NEW

Videos

How to:

Tutorials

How to:

Via Benefits Forms Online

Online Form Builder

Handbooks